A total of sixty-nine percent of people living in the U.S. have at least one social media account, according to a recent Pew Research Center study. This begs the question: What happens to a person’s social media accounts when they die? It turns out, family members and friends of the deceased typically have two options when it comes to handling the deceased’s accounts. They can either be deactivated or memorialized. Last week’s post discussed how to deactivate or memorialize a deceased person’s accounts on Facebook and Instagram. These two social media platforms are the most popular, according to the Pew study. The third and fourth most frequently used platforms weren’t far behind in popularity, though. For this reason, we’ve added part two to our social media how to post. In this week’s addition to last week’s post, we discuss how to deactivate or memorialize a deceased family member’s Pinterest and LinkedIn accounts.

Pinterest is the third most popular socia media platform in the U.S., according to the Pew study. A total of twenty-nine percent of adults in the U.S. have an account and can pin posts to their boards to their hearts content. The process of removing a deceased individual’s Pinterest account is straightforward and similiar to the removal process for Facebook and Instagram. Unlike Facebook and Instagram, however, memorializing a Pinterest account is not an option. Using this link, you can send an email to care@pinterest.com to start the process for removing a deceased individual’s Pinterest account. The following information should be included in the email:

- First, include your full name as well as the full name of the deceased.

- Include a link to the deceased’s account. (Example: pinterest.com/JaneDoe)

- Next, include proof of death, such as a link to an obituary or a copy of the deceased’s death certificate.

- Send proof of your relationship to the person, such as a marriage certificate, birth certificate, or notorized proof of relation.

- Finally, hit send.

It’s important to note that Pinterest cannot provide an individual’s login information to another person. This shouldn’t be a problem when deactivating an account, though. All you need is a link to the person’s page, which you can view by searching for their profile here: https://pinterest.com/all/.

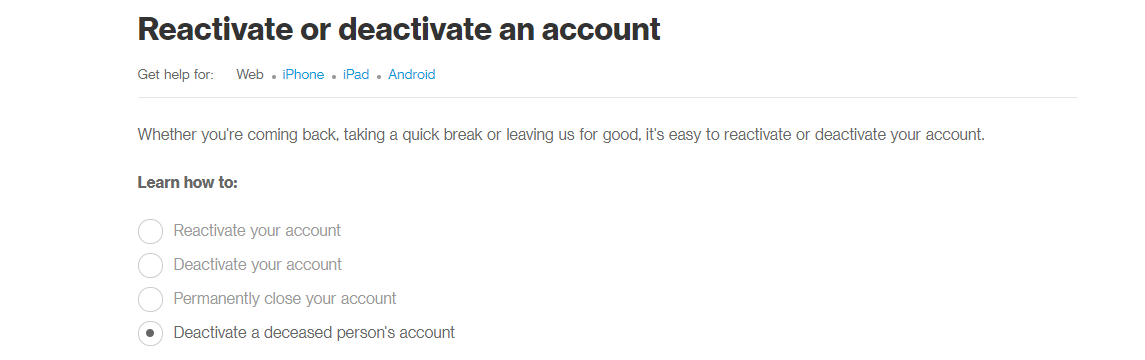

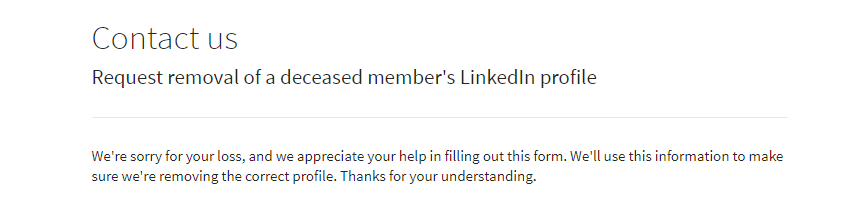

LinkedIn is the fourth most popular social media platform in the U.S. A total of twenty-five percent of adults have a profile on the networking platform’s website. Similar to Pinterest, you cannot memorialize a LinkedIn account. Using this link, you can deactivate an account of a deceased person. To fill out the form, complete the following steps.

- First, fill in your first name, last name, and email address.

- Next, add the deceased’s full name as well as a link to their profile.

- Select your relationship to the deceased from the answers provided. Options include immediate family, extended family, and non-family.

- Add additinal information about the deceased, including the date they passed away, a link to their obituary, and any extra information you’d like to include.

- Finally, type your full name into the box to give a digital signature. Hit submit.

No additional information is needed to submit a request for removal to LinkedIn.

To contact Boyum Law Firm for help with estate planning, click here.

The post Social Media Part Two: Removing The Deceaseds’ Accounts appeared first on Boyum Law.

from WordPress http://ift.tt/2HPQAT0

via IFTTT