The internet is filled with articles on avoiding estate planning mistakes. At Boyum Law Firm, one specific mistake we recommend clients look out for is not updating or using beneficiary designations correctly. Read on to learn more about designating beneficiaries and how to avoid common beneficiary designation mistakes.

What is a beneficiary designation?

A beneficiary designation is an asset-distributing estate planning tool commonly used for retirement accounts and life insurance policies. When an individual designates a beneficiary on their account or policy, they’re naming the person who will receive the asset when they die.

Who is a beneficiary?

A beneficiary is anyone you choose to designate on an account. Often times, people name a spouse, children, friends, trusts or charities as their beneficiary. You can have multiple beneficiaries on your accounts and can even choose what percentage each person receives. People often list a primary beneficiary and secondary beneficiary. If the primary beneficiary dies first or cannot be located, the secondary receives the asset.

Where do beneficiary designations go wrong?

When it comes to estate planning, people generally make two types of beneficiary designation mistakes. The first common mistake is not updating accounts containing a beneficiary designation following a major life event. For example, let’s say a husband originally listed his wife as the sole beneficiary on his retirement account. The couple divorces ten years down the road. Now, the husband wants his children to inherit the asset when he dies. He never gets around to officially making the beneficiary change on his document, so in the end, his ex wife still inherits the funds in his account.

The second common beneficiary designation mistake people make is not being aware of the difference between listing a beneficiary on an account and listing an heir for an asset in their last will and testament. When it comes to distributing assets following an individual’s death, their beneficiary designations always trump what their last will says. This means that if a woman leaves her life insurance policy to her son in her last will but has listed her daughter as the sole beneficiary on her policy, her daughter receives the asset.

Routinely checking beneficiary designations can easily prevents these two common estate planning mistakes. Doing so will save your heirs from potential fights and grant you peace of mind.

How can Boyum Law Firm help you?

Boyum Law Firm can help you with your estate planning, Medicaid planning and probate law needs. To contact Boyum Law, click here.

For more blogs like this one, click here.

The post The Benefits of Double Checking Beneficiaries appeared first on Boyum Law.

from WordPress https://ift.tt/2FndsvQ

via IFTTT

A key component of estate planning involves naming individuals to stand in for you in the case of a medical emergency or death. We’ve written extensively on how to choose a

A key component of estate planning involves naming individuals to stand in for you in the case of a medical emergency or death. We’ve written extensively on how to choose a  Estate planning, like grocery shopping or doing a load of laundry, is a task that’s never completely checked off your to-do list. In fact, routinely updating your estate planning documents ensures your plan best protects you and your loved ones. Your estate plan doesn’t need weekly updates, but a few big life changes create a need for an updated plan. Read on to discover five reasons to update your documents.

Estate planning, like grocery shopping or doing a load of laundry, is a task that’s never completely checked off your to-do list. In fact, routinely updating your estate planning documents ensures your plan best protects you and your loved ones. Your estate plan doesn’t need weekly updates, but a few big life changes create a need for an updated plan. Read on to discover five reasons to update your documents. Prince. Amy Winehouse. Bob Marley. What do these famous musicians have in common? None of them created a last will and testament before they died. A few weeks ago, Aretha Franklin, the Queen of Soul, became the latest star to die without a will. So, what happens to her estate next? Read on to find out.

Prince. Amy Winehouse. Bob Marley. What do these famous musicians have in common? None of them created a last will and testament before they died. A few weeks ago, Aretha Franklin, the Queen of Soul, became the latest star to die without a will. So, what happens to her estate next? Read on to find out. When a loved one passes away, they leave behind many loose ends, such as bills and assets. The person responsible for tying up the loose ends of the deceased is their personal representative. Serving as someone’s personal representative is a daunting task, but you don’t have to go through it alone. In fact, you can and should hire a probate attorney to guide you through the probate process. Here’s why:

When a loved one passes away, they leave behind many loose ends, such as bills and assets. The person responsible for tying up the loose ends of the deceased is their personal representative. Serving as someone’s personal representative is a daunting task, but you don’t have to go through it alone. In fact, you can and should hire a probate attorney to guide you through the probate process. Here’s why: Estate planning is an important task everyone should check off their to-do list for a number of reasons. Creating legal documents is one way to protect you and your loved ones from harm in the event of a medical emergency, for example. It’s easy to question, however, whether or not a daunting task like estate planning deserves a spot on your to-do list. After all, if you aren’t worried about redistributing assets or don’t have children to plan for, do you really need to create a plan? The answer is yes, everyone should create a plan. Here’s why:

Estate planning is an important task everyone should check off their to-do list for a number of reasons. Creating legal documents is one way to protect you and your loved ones from harm in the event of a medical emergency, for example. It’s easy to question, however, whether or not a daunting task like estate planning deserves a spot on your to-do list. After all, if you aren’t worried about redistributing assets or don’t have children to plan for, do you really need to create a plan? The answer is yes, everyone should create a plan. Here’s why: At Boyum Law Firm, we end every blog post with an invitation for our readers to contact us with their estate planning, Medicaid planning, and probate law needs. Whether you have questions that need answers or are ready for a free consultation, we want to assist you in any way we can. Read on to discover all the ways our firm can help you today.

At Boyum Law Firm, we end every blog post with an invitation for our readers to contact us with their estate planning, Medicaid planning, and probate law needs. Whether you have questions that need answers or are ready for a free consultation, we want to assist you in any way we can. Read on to discover all the ways our firm can help you today. Blended families, or families that include a stepparent, stepsibling or half-sibling, are common. In fact, according to a Pew Research Center

Blended families, or families that include a stepparent, stepsibling or half-sibling, are common. In fact, according to a Pew Research Center  Imagine lying in a hospital bed. You were in a car accident, suffered severe injures, and are in a permanent vegetative state. As the doctor explained to your loved ones, you won’t survive without life support. So, what happens to you next? Well, that depends on whether or not you’ve created a living will. Read on to discover what a living will is and how it can protect you and your loved ones from a scenario like the one above.

Imagine lying in a hospital bed. You were in a car accident, suffered severe injures, and are in a permanent vegetative state. As the doctor explained to your loved ones, you won’t survive without life support. So, what happens to you next? Well, that depends on whether or not you’ve created a living will. Read on to discover what a living will is and how it can protect you and your loved ones from a scenario like the one above. Estate plans may look like unassuming pieces of paper, but for being made of something simple, they’re shrouded in mystery. In order to clear up some of the mystery surrounding estate planning, we’re debunking three common estate planning myths.

Estate plans may look like unassuming pieces of paper, but for being made of something simple, they’re shrouded in mystery. In order to clear up some of the mystery surrounding estate planning, we’re debunking three common estate planning myths. From appointing a legal guardian for your kids to naming a personal representative, creating a last will and testament enables you to cover a lot of ground when it comes to estate planning. Make sure you utilize your legal document to its fullest potential by using your last will and testament to do the following:

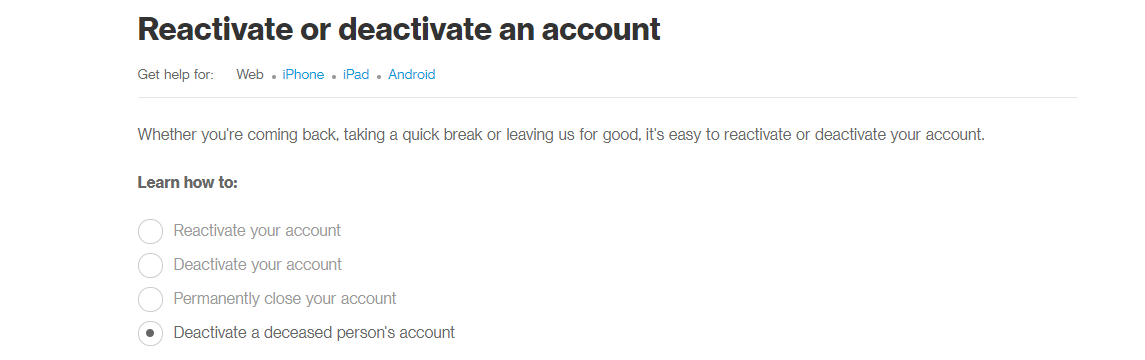

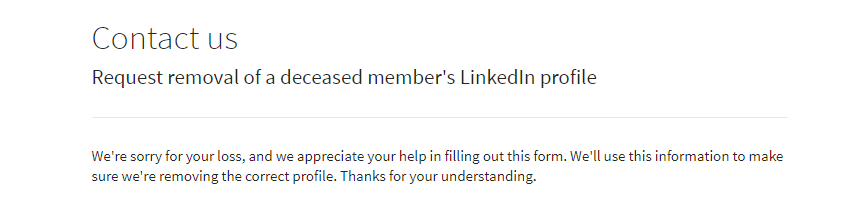

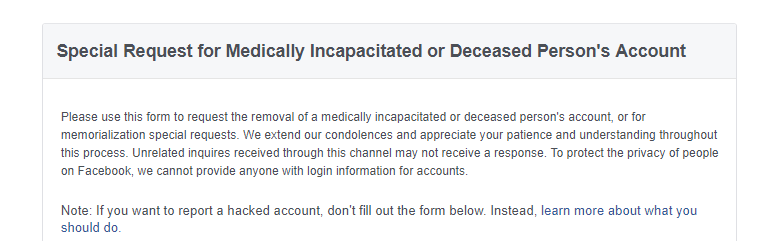

From appointing a legal guardian for your kids to naming a personal representative, creating a last will and testament enables you to cover a lot of ground when it comes to estate planning. Make sure you utilize your legal document to its fullest potential by using your last will and testament to do the following: In the age of technology, the number of online accounts people own is increasing. These accounts, otherwise known as digital assets, affect your estate plan. Important documents, such as bank statements and bills, used to arrive in the mail. Now, most people receive these documents via password-protected email accounts. This impacts your estate when you die because it affects your personal representative’s ability to gather your assets and pay your debts. Additionally, other online assets, such as your social media accounts, will need to be

In the age of technology, the number of online accounts people own is increasing. These accounts, otherwise known as digital assets, affect your estate plan. Important documents, such as bank statements and bills, used to arrive in the mail. Now, most people receive these documents via password-protected email accounts. This impacts your estate when you die because it affects your personal representative’s ability to gather your assets and pay your debts. Additionally, other online assets, such as your social media accounts, will need to be  You have the perfect business idea, but mountains of paperwork and confusing legal requirements are preventing your dream from becoming reality. Contacting Boyum Law Firm for help makes the process of setting up your business easier. Here’s why:

You have the perfect business idea, but mountains of paperwork and confusing legal requirements are preventing your dream from becoming reality. Contacting Boyum Law Firm for help makes the process of setting up your business easier. Here’s why: Talking about death, end-of-life decisions, and money is uncomfortable but necessary when estate planning. It’s not enough to talk to an attorney in order to make a plan, either. Sharing information with your loved ones and the reasoning behind your decisions is also important. Here’s why:

Talking about death, end-of-life decisions, and money is uncomfortable but necessary when estate planning. It’s not enough to talk to an attorney in order to make a plan, either. Sharing information with your loved ones and the reasoning behind your decisions is also important. Here’s why: As an estate planning law firm, Boyum Law strives to help others create documents that will provide peace of mind and clarity during life’s most difficult situations. Creating estate planning documents, such as a last will and testament, provides many benefits. These benefits include the ability to indicate in advance how you would like your assets distributed when you die. But what happens if you die without a last will and testament in Nebraska? How will your assets be distributed to heirs? The laws of intestate succession determine who gets what in Nebraska.

As an estate planning law firm, Boyum Law strives to help others create documents that will provide peace of mind and clarity during life’s most difficult situations. Creating estate planning documents, such as a last will and testament, provides many benefits. These benefits include the ability to indicate in advance how you would like your assets distributed when you die. But what happens if you die without a last will and testament in Nebraska? How will your assets be distributed to heirs? The laws of intestate succession determine who gets what in Nebraska. A personal representative, otherwise known as an executor, is the person responsible for handling your estate when you die. Handling an estate

A personal representative, otherwise known as an executor, is the person responsible for handling your estate when you die. Handling an estate  An estate planning attorney usually isn’t the kind of lawyer you think about contacting when getting a divorce. With other legal matters to settle, contacting your estate planner and updating your documents is the last thing on your mind. Estate plan updates should be at the top of your to-do list, however. Here’s why:

An estate planning attorney usually isn’t the kind of lawyer you think about contacting when getting a divorce. With other legal matters to settle, contacting your estate planner and updating your documents is the last thing on your mind. Estate plan updates should be at the top of your to-do list, however. Here’s why: An Alabama court unsealed author Harper Lee’s last will and testament in February, according to

An Alabama court unsealed author Harper Lee’s last will and testament in February, according to